For the past decades, the Hong Kong private residential sector has focused on offering small flats to address the housing supply and demand imbalance. However, the conflict amongst the quantity of housing supply, the quality of living standard and the sustainability of developments is becoming increasingly severe. Focusing on the number, not the quality and sustainability, of the new developments will not be helpful to solve Hong Kong’s housing problem.

The rise of “nano flat” in Hong Kong

When it comes to Hong Kong, we can’t help but notice that buildings are getting taller. Apart from pursuing tall buildings to seek more space for living, the market turns to offering tinny, mini-sized flats to satisfy the huge demand of home ownership. Therefore, small flats represented one of the best choices a couple of years ago for some developers in Hong Kong.

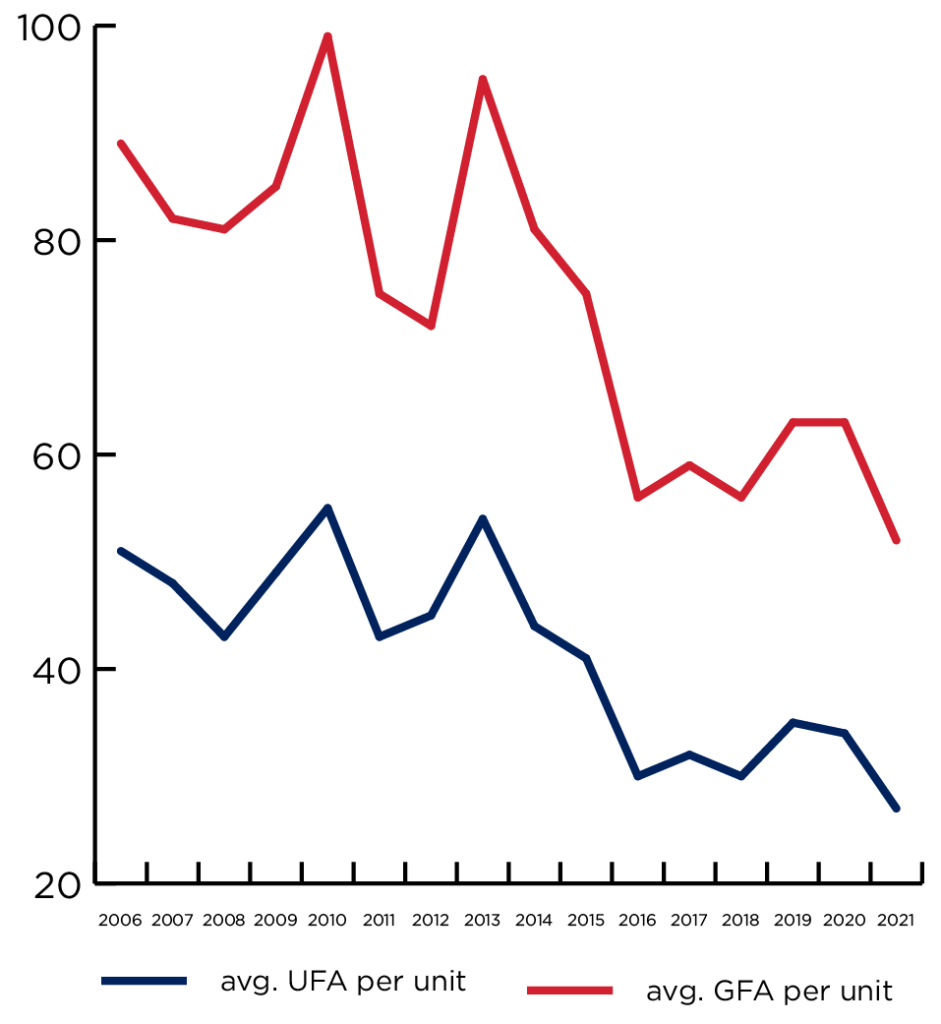

From the historical data, the average size of residential flats in Hong Kong has been on a downtrend for the past 16 years (Figure 1). In 2021, the average Domestic Gross Floor Area (GFA) per Unit and Domestic Usable Floor Area (UFA) per Unit were 52m2 and 27m2, respectively, which are about 30% and 34% below the average of the past 16 years.

Figure 1 The average size of residential flats in Hong Kong

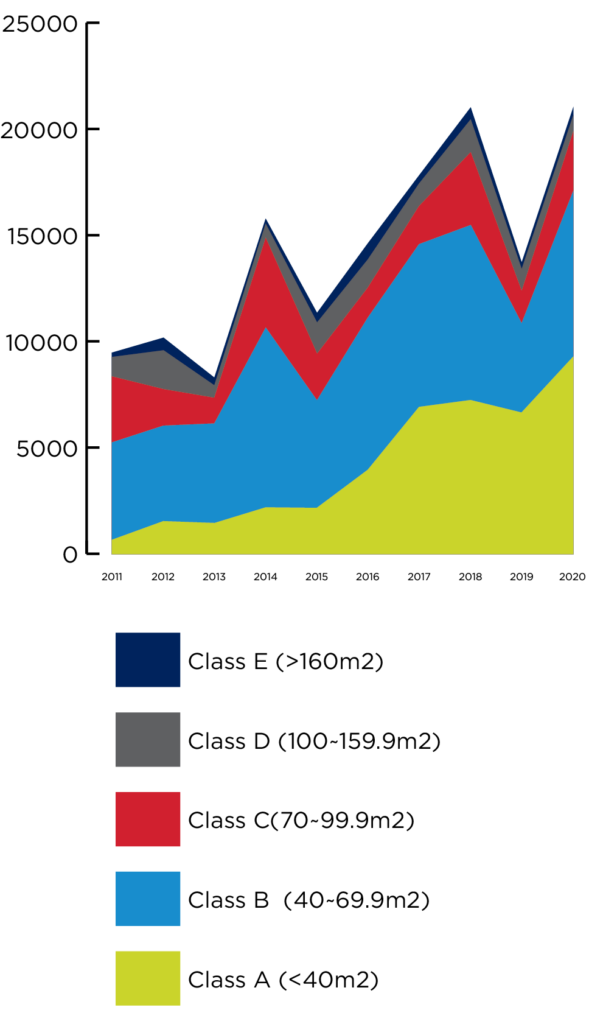

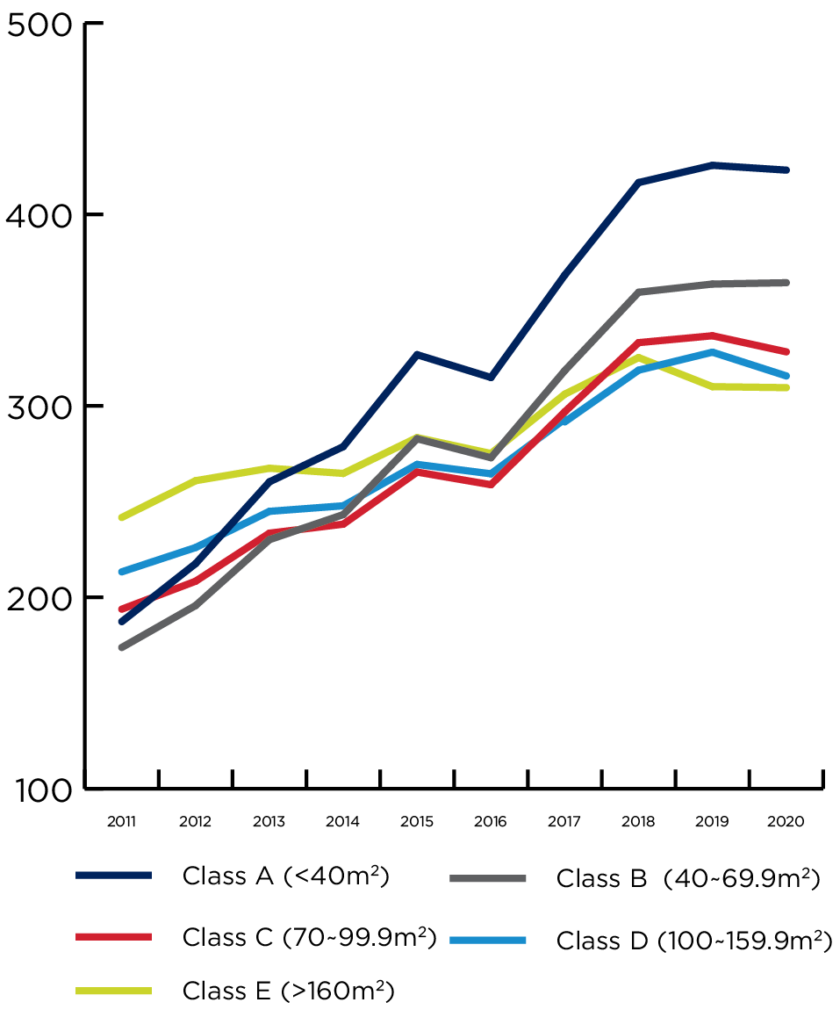

With the decreasing size of the unit, a new term — “nano flat”— has emerged in the market. Generally, the term “nano flat” refers to residential apartments with a saleable area (including bathroom and kitchen) smaller than 24m2 (260ft2)[1]. The rise of such “nano flats” has been partly driven by the relaxation of Fire Safety (Building) Ordinance and Building Ordinance more than ten years ago. After the relaxation, new developments are allowed to have open kitchens, windowless bathrooms and bonus areas by including building balconies and glass curtain walls. The developers have leveraged these measures to build smaller flats at more affordable prices targeted for first-time buyers. Statistically, the private residential developers showed a growing interest in small units (i.e., Class A and B[2]) over the past ten years, especially after 2016 (Figure 2).

Figure 2 Completions of private residential units by Classes (2011-2020)

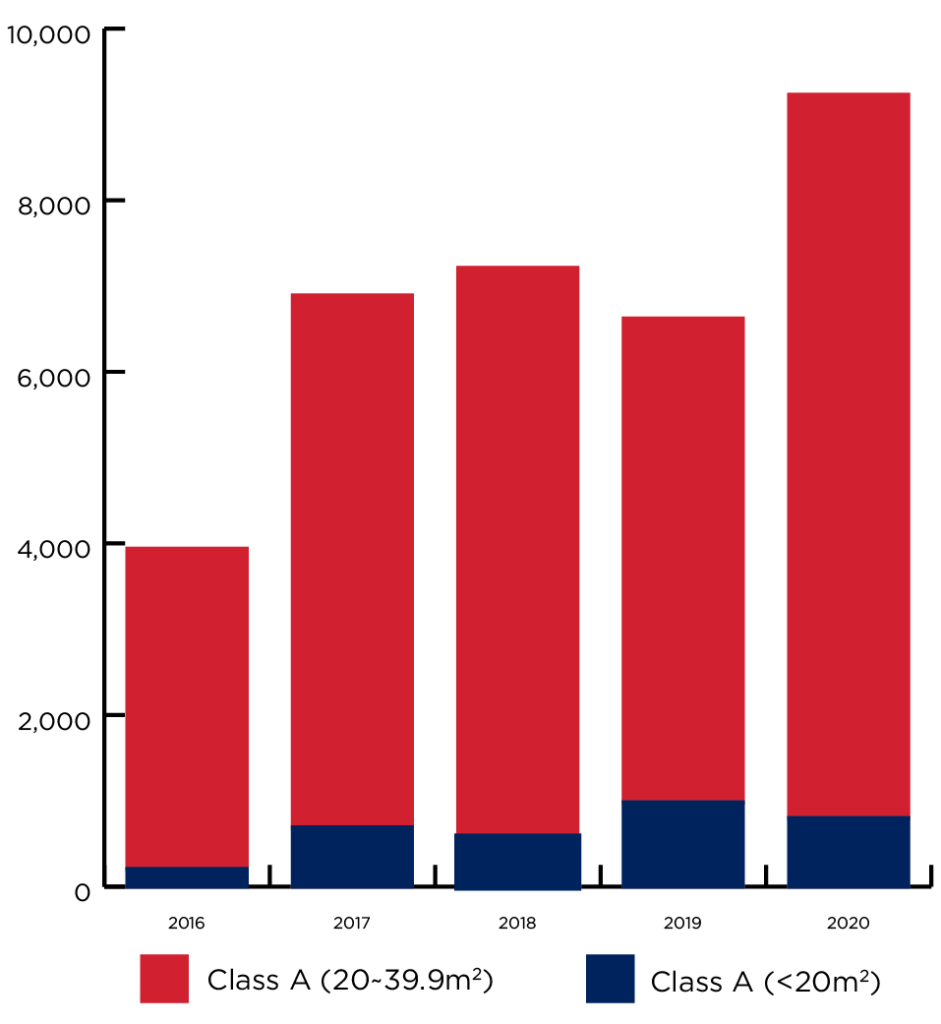

Developers began to build even smaller units with a domestic floor area less than 20m2 since then. Such units accounted for only 1.41% of completions of private units in 2016 but grew to 7.2% and 3.83% in 2019 and 2020, respectively (Figure 3).

Figure 3 Completions of Class A units by size (2016-2020)

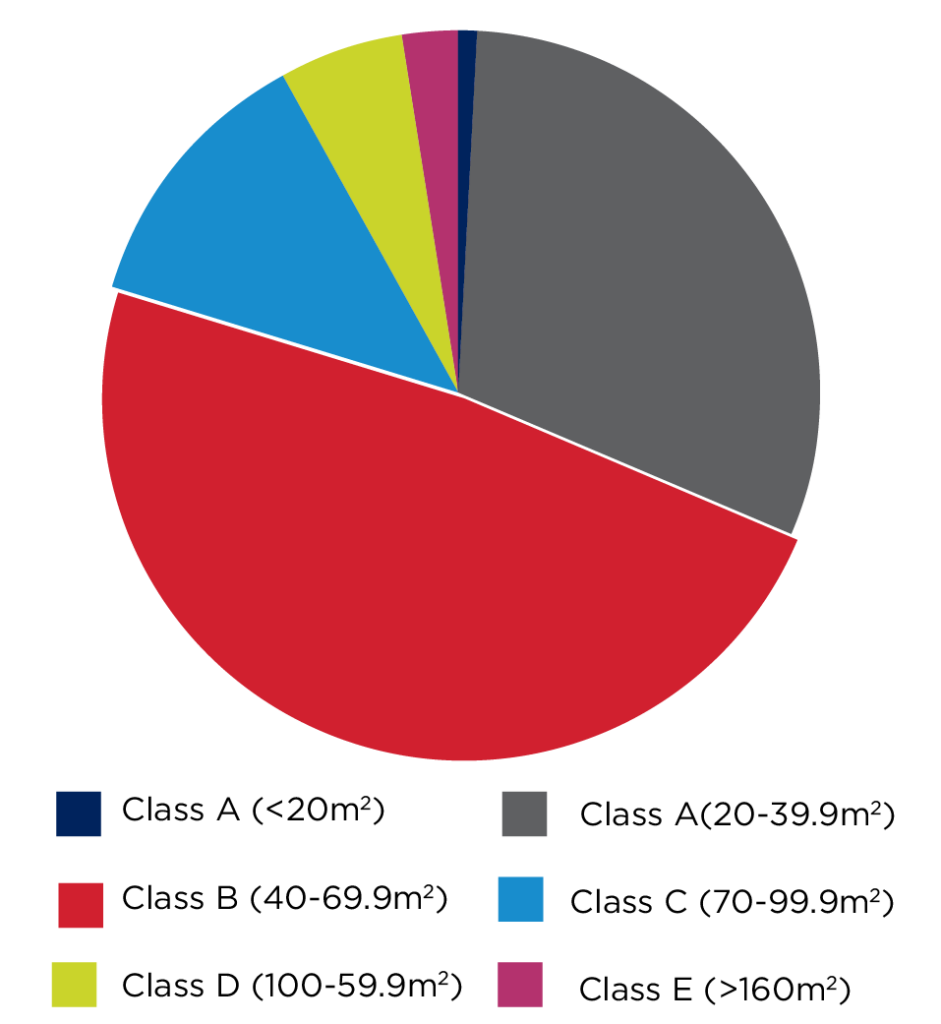

However, on the demand side, the popularity of “nano flats” is beginning to drop. At the end of 2020, the total number of small and medium units accounted for 92% of the total private domestic stock (Figure 4), while take-up dropped by 36% to 10787 units and vacancy rose to 45260 units or 4.0% of the stock.

Figure 4 The stock of private domestic units at year-end of 2020

On the one hand, speculative demand over Hong Kong’s “nano flats” appears to be over, following the city’s median home price decline. History suggests that small flats tend to suffer more when there are price adjustments. During 2015-16, the price of flats smaller than 40m2 sagged 12 per cent, compared with just a 9 per cent dip for those sized from 70 to 100m2 (Figure 5).

Figure 5 Price indices of private residential units by Classes (1999=100)

On the other hand, when housing prices start to sag, the rigid demand usually plummets as the first-time buyers turn their attention to larger units at the same price point. Practically, price changes make people look for units with similar price tags but more living space. In addition, price indices of private residential units of Class A increased sharply over the last decades and its indices exceeded all types of units after 2013 (Figure 5). This tendency also discouraged first-time buyers.

A balance between “nano flats” supply and living standard

“Nano flats” have sprung up after easing fire safety guidelines in 2011 and building planning guidelines in 2012. However, the maintenance of ventilation systems (e.g., open kitchens, windowless bathrooms, etc.) had often been neglected in the design stage, posing sanitation risks when it was used. More than 80 per cent of these tiny flats have balconies, utility platforms or curtain walls as the only source of natural lighting, which account for about 10 per cent of the saleable area on average. These areas contribute little to the actual living space of the already-tiny homes.

Unlike the former policy that imposed a minimum number of flats on land sales to encourage the construction of smaller homes and relaxed building rules, the Hong Kong’s government said in 30 December 2021 that it will set a minimum home size to counter the trend for “nano flats” supply. A minimum flat size threshold of 26m2 in the saleable area will be imposed on developers in a land sale clause[3]. This new measure could help improve living conditions and reduce the number of “nano flats” in Hong Kong in the long run. Hong Kong’s movement sets a signal to the market that we are narrowing the gap compared with global levels, like the UK at 37m2 and Singapore at 46m2, and we are addressing the balance between flat supply and living standard.

Cost differences between “nano” and regular flats

We selected two typical residential buildings with different scales to further explore the cost differences between the “nano flats” design and the regular flats design. The “nano flats” design means that the majority of the flat units offered by the project are below 24m2. The “nano flats” design project selected by this article offers flats with saleable areas from 19 to 27m2 (average 22m2/unit), and the regular one offers flats from 26 to 93m2 with an average size of 45m2 per unit (see Figure 6). We found that the construction unit costs in terms of structure, façade, architectural works and building services of “nano flats” design project are higher than that of the regular one (Table 1).

420 m2 CFA (typical floor)

160 m2 CFA (typical floor)

Figure 6 Typical floor plan of two developments

| Regular flats design | “Nano flats” design | Difference | |

|---|---|---|---|

| Structure | 3,300 – 4,200+ | 4,200 – 5,200+ | + 25% |

| Façade | 5,000 – 6,400+ | 6,200 – 8,500+ | + 29% |

| Architectural works | 7,600 – 9,200+ | 8,700 – 10,300+ | + 13% |

| Building services | 7,400 – 8,700+ | 8,500 – 10,000+ | + 15% |

| Total | 23,300 – 28,500+ | 27,600 – 34,000+ | + 19% |

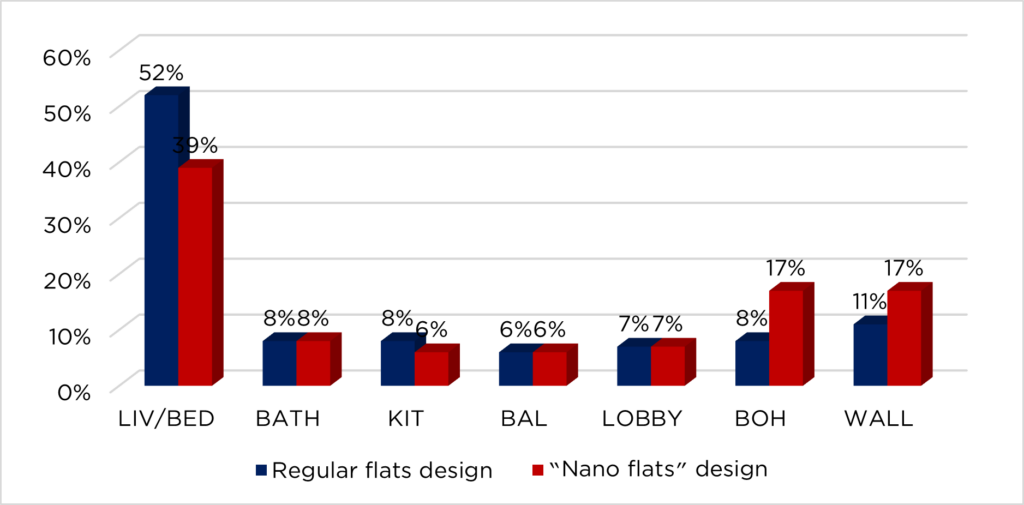

The most significant differences resided in the unit cost of façade (+29%) and followed by structure (+25%). From the functional perspective, non-living space (e.g., wall-occupied areas, back of house, lift lobby and balcony/utility platform) of the “nano flats” design project occupied more than the regular one (Figure 7). Besides, the façade to CFA ratio of the “nano flats” design project is much higher than the regular one (i.e., 1.25m2 Façade / m2 CFA vs 0.74m2 Façade / m2 CFA, respectively). Such functional areas contribute little to the actual living space of the “nano flats” but increase the unit cost of projects.

Figure 7 Distribution of key functional floor areas (% of CFA)

Moving forwards

Maintaining the healthy development of the private residential property market is one of the essential objectives of Hong Kong Government’s housing policies. To gradually avert the current supply-demand imbalance in the private residential property market, the Government has formulated and announced Long Term Housing Strategy to stabilise the residential property market through steady land supply and appropriate demand-side management measures and promote good sales and tenancy practices for private residential properties. The supply target of 129,000 units for the ten years from 2021-22 to 2030-31 will be met through various land supply sources.

In addition to stabilising the market from political and regulative aspects, promoting construction innovation and automation, such as Modular Integrated Construction (MiC), would provide economic, social and environmental benefits for the developers, the contractors, the end-users through reducing manpower resources, minimising site accidents, producing high-quality living space, as well as reducing carbon emission and carbon footprint throughout the entire life cycle of the residential developments.

To systematically address the unique challenges the Hong Kong housing industry faces, we firmly believe that quantity-quality-sustainability balance is a practical way to ensure win-win outcomes for all parties, consultants included.

Sources

[1] Lax regulations behind surge in Hong Kong’s ‘nano flats,’ land use group says

[2] Class A flats, with saleable area less than 40 m2; Class B flats, with saleable area of 40 m2 to 69.9 m2; Class C flats, with saleable area of 70 m2 to 99.9 m2; Class D flats, with saleable area of 100 m2 to 159.9 m2; and Class E flats, with saleable area of 160 m2 or above.

[3] New measures to help reduce number of ‘nano’ flats | Hong Kong | China Daily (chinadailyhk.com)

[4] Buildings Department – Monthly Digest

[5] Hong Kong Property Review 2021

FURTHER INFORMATION: