Offering clients the level of certainty they need to make critical, real-time decisions to ensure the commercial success of their infrastructure projects.

As a result of the Francis Scott Key Bridge collapse disaster, Infrastructure is now back in the public’s eye. With the likely use of emergency federal funds to help rebuild it, RLB will monitor how construction costs are affected and how risks are addressed over the near term.

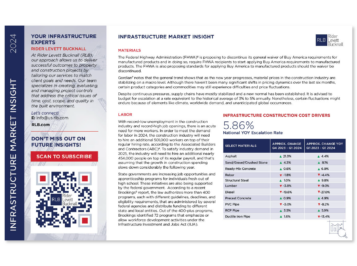

Buy America

On 12 March 2024, the United States Federal Highway Administration (FHWA) issued a Notice of Proposed Rulemaking (NRPM) to discontinue its general waiver of Buy America requirements for manufactured products on FHWA-funded projects. This FHWA proposal also includes provisions for standards on manufactured products in line with the Build America, Buy America Act (BABA) provisions of the Infrastructure Investment and Jobs Act (IIJA). Along with their proposal, FHWA on the same day issued a Request for Information (RFI) to the Construction Industry seeking input on the domestic availability, market readiness, and timeliness of product supply of specific manufactured products commonly used in FHWA-funded projects. This RFI further asks for specific detailed information on which products cannot currently be readily supplied domestically in the United States. If any results justify, FHWA may issue time-limited and targeted waivers pertaining to those select materials. On a related note, while not FHWA-funded, the Brightline West project in California and Nevada, which was awarded a grant by the Federal Railroad Administration (FRA), made news at the end of 2023 for requesting a Buy America waiver on several critical products due to their potential domestic non-availability.

Transit-Oriented Development Financing

Transit-Oriented Development (TOD) has trended upward in the post-Pandemic economy, and new government programs such as TIFIA49 (TIFIA stands for Transportation Infrastructure Finance and Innovation Act), which allows public agencies up to 49% borrowing on transit and transit-oriented development projects, and Railroad Rehabilitation & Improvement Financing (RRIF), which allocates up to $35 billion to finance railroad infrastructure projects, are aimed at supporting this growth. TOD projects are generally eligible for assistance if they are located within ½ mile of public transportation station locations, and urban areas throughout the Country have been applying for use of this financing. Some cities are not finding this to be an easy and streamlined process, though. The City of Pittsburgh, whose commercial office market has been hit hard over the past four years, has investigated RRIF financing opportunities for converting office buildings into residential, and is proposing that the Biden Administration and US Department of Transportation make changes to the financing requirements. In particular, the City of Pittsburgh is requesting a decrease in the duration for loan closing from 18 months to 6 months, a major streamline of environmental reviews, a reduction in RRIF Oversight costs, clarification that design and engineering costs can also be financed, and a waiver of credit risk premiums, asserting that the current RRIF regulations are not conducive to supporting this type of development.

Executive Order for Registered Apprenticeships

On 06 March 2024, the Biden Administration issued an Executive Order on Scaling and Expanding the Use of Registered Apprenticeships in Industries and the Federal Government and Promoting Labor-Management Forums. The Executive Order states that the aims of this Program are: to invest in workers’ skills, reduce barriers to employment, promote job quality, equity, inclusion, and accessibility, and to attract a diverse workforce to meet the Nation’s critical needs. Soon after the Executive Order was issued, one major trade association opined that it creates an artificial demand for contractors and apprentices participating in Government-Registered Apprenticeship Programs (GRAPs) by directing federal agencies to require or incentivize GRAP participation on federal and federally assisted projects, and also that they believe that it appears to disproportionately benefit unionized contractors and unions. As construction labor struggles to keep up with demand, finding creative ways to attract and train workers will continue to be a critical challenge at the forefront.

Trends Toward Progressive Design-Build

Recent years have seen a change in approach to large Infrastructure Design-Build and P3 projects. While most of them had been delivered under the Fixed-Price model, where the winning team is selected on both committed cost and qualifications/approach, there is now a growing trend toward Progressive Design-Build, where the winning is team is instead selected based on qualifications, project approach, and potentially on certain non-binding cost estimates/targets. With the large amount of risk and uncertainty inherent in these complex projects, the Progressive Design-Build approach contributes to mitigation of major design, constructability, and stakeholder risks, leading to more educated and transparent cost and schedule proposals from the Design-Builder. This delivery method also provides the project Owner with a more accessible “off-ramp” should their position on the project change.

Highway Trust Fund Re-Authorization

The current authorization for federal highway programs expires on 30 September 2026, and the Congressional Budget Office (CBO) projects that balances in both the highway and transit accounts of the Highway Trust Fund will be exhausted in 2028. Current tax rates credited to the trust fund are not expected to keep pace with need and inflation, as a roughly $241 billion shortfall over the next 9 years is projected by the CBO. As a result, level of service and funding source decisions must go hand-in-hand as policymakers consider future re-authorization. Possible funding sources include one or more of the following: increasing the existing fuel tax (which rate has not increased since 1993), assessing new taxes and/or fees (possibly on electric vehicles or on miles traveled (VMT) by commercial trucks), or a re-allocation of money from the US Treasury’s general fund. As funds are expected to decrease in the near term, more emphasis is expected to be placed on cost-benefit analyses that could be used to prioritize projects that show to be the better use of money. In addition to this federal funding challenge, most of our states, which have not indexed their own gas taxes recently, will also face similar issues.

FURTHER INFORMATION:

Josh Marks